- Invest With Pete

- Posts

- Could This Be Bad For Market?

Could This Be Bad For Market?

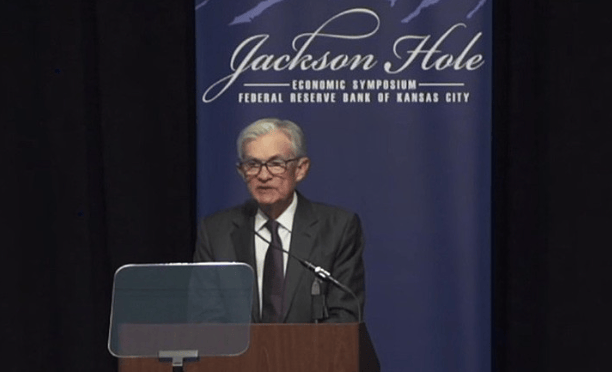

So Powell spoke at Jackson Hole and as always, the market listened.

That banner design is a crime

📢 What did he say?

In short, he opened the door for rate cuts if the labour market continues to weaken. He acknowledged that inflation remains a concern, especially from tariffs, but also admitted that job market softness is creeping in.

“The balance of risks appears to be shifting,” he said.

And just like that, rate cut bets for September ramped up.

📈 On cue, the market spiked right after the speech. But here’s the thing

By Monday, that bullish bounce fizzled out. The S&P gave back some gains and closed lower.

Because while investors love the idea of rate cuts, the reason behind those cuts

Not so pretty.

💡 A weaker job market is not something to cheer for

Yes, lower rates can boost stock prices

Yes, that’s good for valuations in the short term

But let’s not forget the other side of the coin

🔹 Slower hiring

🔹 Rising unemployment

🔹 Cautious business spending

🔹 And if it spirals, possible layoffs

Powell even said it himself

If job market risks materialize, they “can do so quickly in the form of sharply higher layoffs and rising unemployment.”

That’s not a party. That’s a red flag waving slowly in the wind

🤔 So what should we do as investors?

The market wants rate cuts

But it also wants strong earnings, confident consumers, and stable growth

In fact, you can see that rate cuts often precedes a market pullback

So while the headlines may scream “Fed pivot,” stay clear-eyed. This is not 2020. Rate cuts today do not mean the same as they did during ZIRP years

If anything, now is the time to stay sharp

✅ Focus on quality businesses

✅ Watch labour and inflation data like a hawk

✅ Manage risk and don't blindly chase rate-cut euphoria

I’ll be watching this closely and sharing any moves I make inside the next Invest with Pete Live session

Till then, stay steady. Don’t celebrate too early. Lower rates may come, but they might bring baggage

Meanwhile check this out for more crypto news

How A Small Crypto Investment Could Fund Your Retirement

Most people think you need thousands to profit from crypto.

But this free book exposes how even small investments could transform into life-changing wealth using 3 specific strategies.

As markets recover, this may be your last chance to get positioned before prices potentially soar to unprecedented levels.

Happy Hunting!

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.