- Invest With Pete

- Posts

- NVDA is in trouble?

NVDA is in trouble?

💥 Is NVDA in Trouble? Or Is This the Best Buying Signal We’ve Seen in Months?

Let’s unpack the market drama around Nvidia, Meta, and Google… and why the loudest headlines often hide the biggest opportunities.

📰 Market Recap

Nvidia took a hit this week after reports surfaced that Meta is exploring buying billions of dollars’ worth of AI chips from Google. The market reacted fast, NVDA share price slipped as investors wondered whether Meta was pivoting away from Nvidia.

But while the news sounds alarming… the underlying story paints a very different picture.

🤔 What’s Actually Going On?

Here’s the nuance the headlines missed:

1. Meta isn’t replacing Nvidia, they’re adding more sources.

Meta is already on track to spend around $100 billion on Nvidia hardware over the coming years.

And even with that massive spend, they’re still capacity-constrained. Meta needs more compute than Nvidia can ship today. So they’re supplementing, not substituting.

2. If Nvidia doubled output tomorrow, Meta would still be short.

That’s how intense AI infrastructure demand is right now.

This isn’t a crack in Nvidia’s moat, it’s confirmation of how enormous the AI build-out has become.

The demand curve is parabolic.

The supply curve can’t keep up.

That’s bullish.

3. The AI hardware cycle is becoming a multi-year supercycle.

Data centers are scaling like the early-2000s internet infrastructure boom but on steroids. Hyperscalers are racing to build the compute layer that will power the next decade of AI products.

Nvidia, with its ecosystem (CUDA), software stack, and performance lead, remains at the center of that build-out.

Even if Meta buys Google chips…

Even if they build their own chips…

Even if other players enter the arena…

There’s more than enough demand for everyone and Nvidia still commands the premium seat.

⚠️ Risks to Keep in Mind

No narrative is bulletproof.

Here are the real risks, not the exaggerated ones:

Big Tech’s in-house chips could erode Nvidia’s pricing power over time.

A major performance leap from a competitor could compress Nvidia’s margins.

Geopolitical/regulatory pressure on chip exports could tighten the screws.

Expectations baked into the stock price are very high.

But none of these risks show up “tomorrow.”

They’re slow-burn risks, not immediate threats.

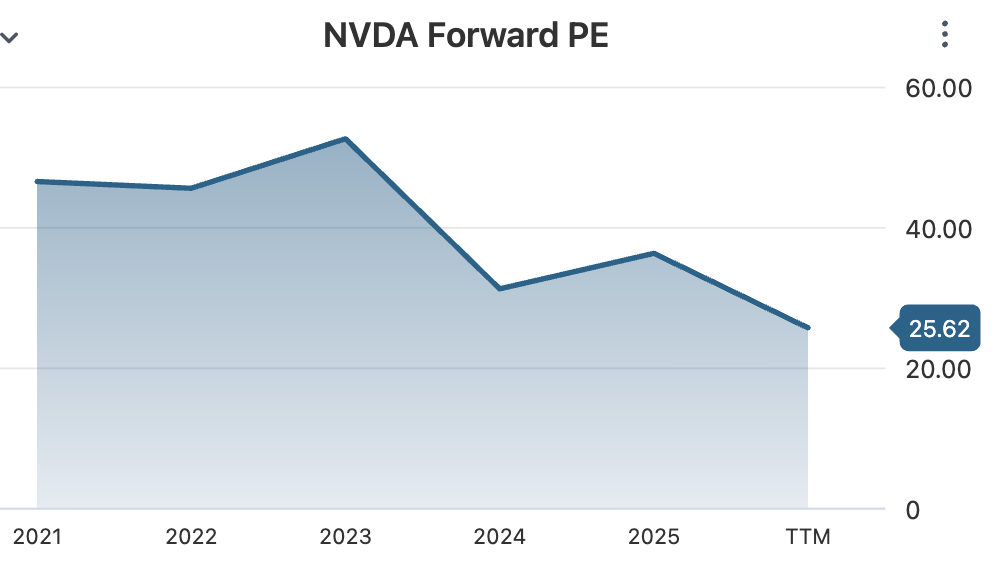

Nvidia is currently trading at a multi-year low valuation

Source: Stockanalysis.com

📈 Investment Takeaway

For long-term investors, here’s the play:

Don’t let headline fear shake you out of a long-term thesis.

Nvidia’s ecosystem remains deeply entrenched: hardware, software, dev tools, community.

AI demand is exploding faster than supply.

Hyperscalers need every chip vendor, not just one.

A selloff on misunderstood headlines? Historically… that’s opportunity.

It’s not about chasing hype.

It’s about understanding scale and AI demand is scaling beyond what any single chipmaker can meet.

Meanwhile, check this out:

Don’t get SaaD. Get Rippling.

Remember when software made business simpler?

Today, the average company runs 100+ apps—each with its own logins, data, and headaches. HR can’t find employee info. IT fights security blind spots. Finance reconciles numbers instead of planning growth.

Our State of Software Sprawl report reveals the true cost of “Software as a Disservice” (SaaD)—and how much time, money, and sanity it’s draining from your teams.

The future of work is unified. Don’t get SaaD. Get Rippling.

🎯 Final Word

Everyone’s asking:

“Is Nvidia in trouble?”

My answer?

Not even close.

This isn’t a weakening, this is a flex of how massive the AI wave has become.

And when demand is this overwhelming…

The companies at the center of the ecosystem tend to win big.

Stay smart, stay calm, and stay invested in the long game.

See you next issue.

Happy Hunting!

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.