- Invest With Pete

- Posts

- one ratio all investors must know

one ratio all investors must know

Why companies go broke trying to please you. 💸

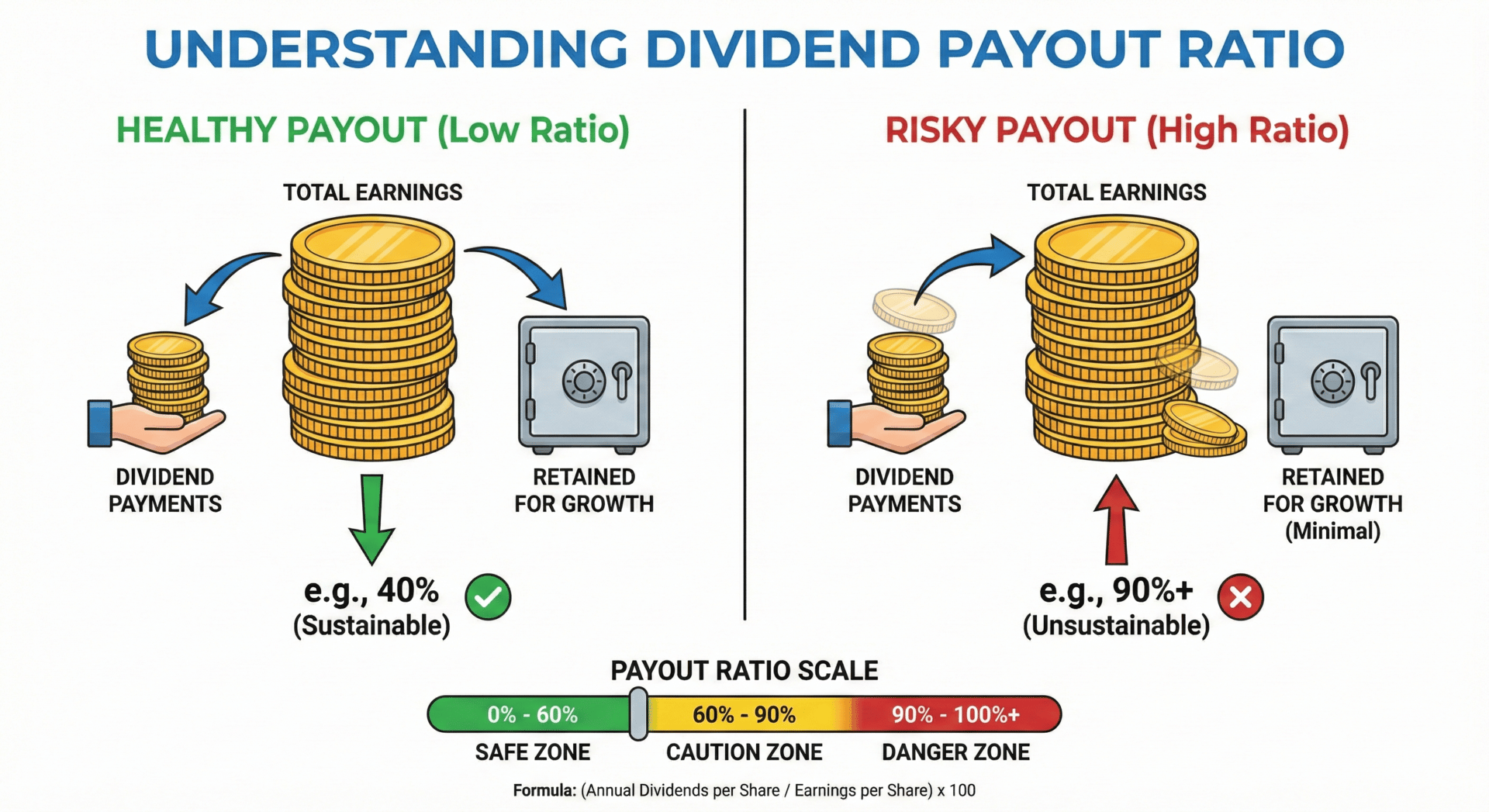

Last week, we talked about why a 12% yield is often a trap. Today, I want to give you the #1 tool I use to spot those traps in under 60 seconds.

It is called the Payout Ratio.

Think of a company’s earnings like a monthly salary. If you earn $5,000 a month but your rent, food, and bills cost $4,900... you have zero room for error. If you get a flat tire or an unexpected medical bill, you are in big trouble.

In the dividend world, it works exactly the same way:

🟢 The Healthy Company: Earns $1.00 per share and pays you $0.40 in dividends. This is a 40% Payout Ratio. They have a massive "cash cushion" to grow the business and keep paying you even if they have a bad quarter.

❌ The Sinking Ship: Earns $1.00 per share but tries to pay you $1.10 in dividends. This is a 110% Payout Ratio. 🚩

Where is that extra $0.10 coming from? They are either taking on expensive debt or dipping into their savings just to keep up appearances. This is a desperate move to keep the "high yield" look. This is exactly how giants like Intel or Walgreens ended up slashing their payouts and watching their stock prices crater.

The Pete Rule of Thumb: For most stocks, I look for a payout ratio under 60%. If it is higher than that, the alarm bells are ringing. The Passive Income Generator is starting to fail.

I am teaching the full "Deep Dive" version of this. I will cover the critical exceptions like REITs and Utilities inside my brand new course: Dividend Market Genius.

If you want to learn how to build a portfolio of "Healthy Companies" that pay you month after month without the stress of a sudden dividend cut, you need to be on this list. I will be sending out more mini lessons like this to the waitlist group first. Plus, you will get that exclusive Founders Discount I mentioned (hint: it is a massive discount).

👇 Join the Dividend Market Genius Waitlist here: 👉 https://rebrand.ly/dmgwaitlist

Let’s stop gambling and start building. 🥂 Stay tuned for the next lesson

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.