- Invest With Pete

- Posts

- smart men go broke in 3 ways

smart men go broke in 3 ways

Hi everyone,

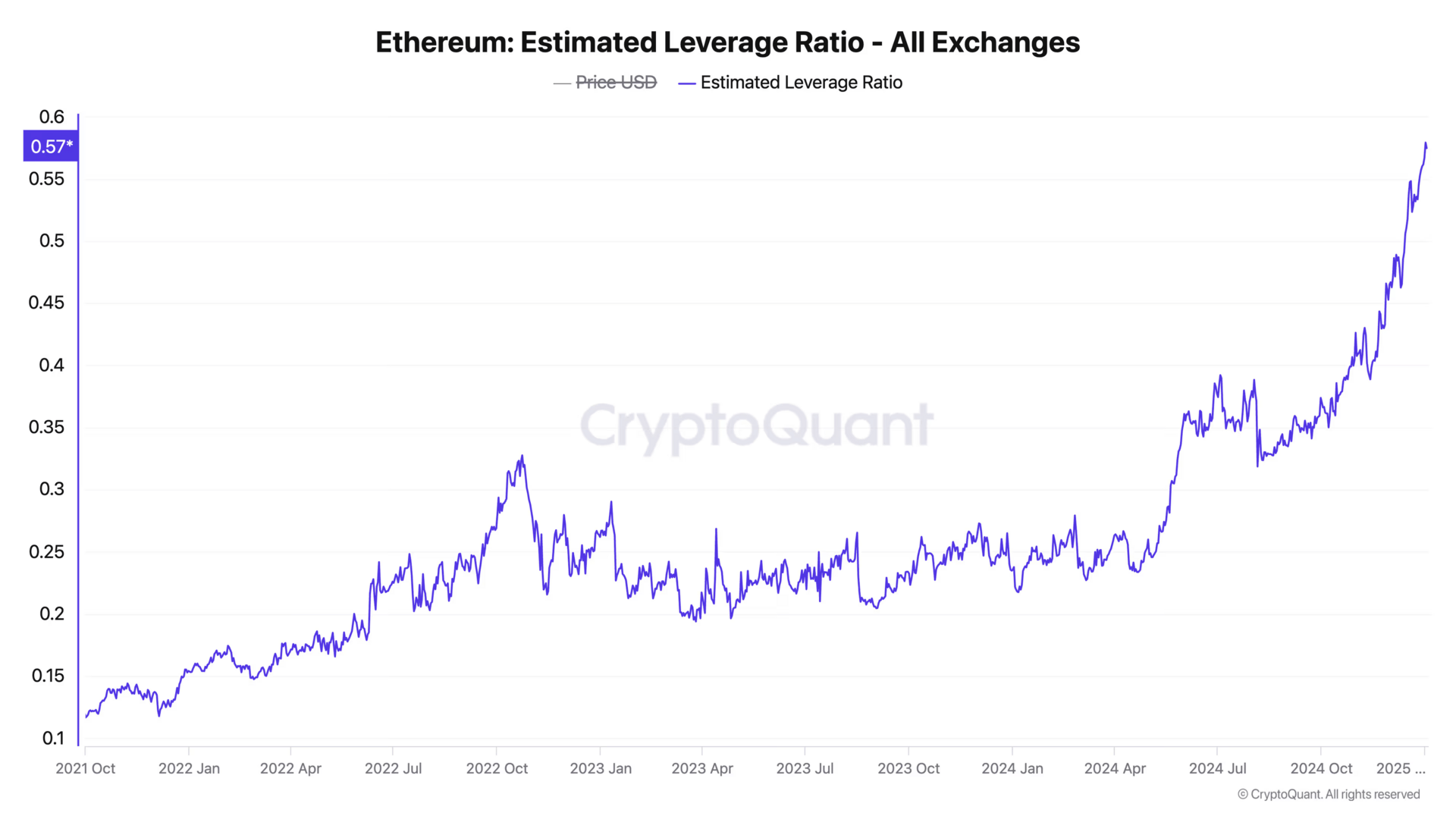

This week’s market action felt like déjà vu. Trump’s fresh message on China tariffs rattled global markets, and the crypto market suffered its largest liquidation event in history, wiping out over $19 billion in leveraged positions within a single day. Bitcoin and Ethereum plunged as traders scrambled to unwind positions, and once again, investors were left asking how something that seemed unstoppable could collapse so fast.

Source: DLnews

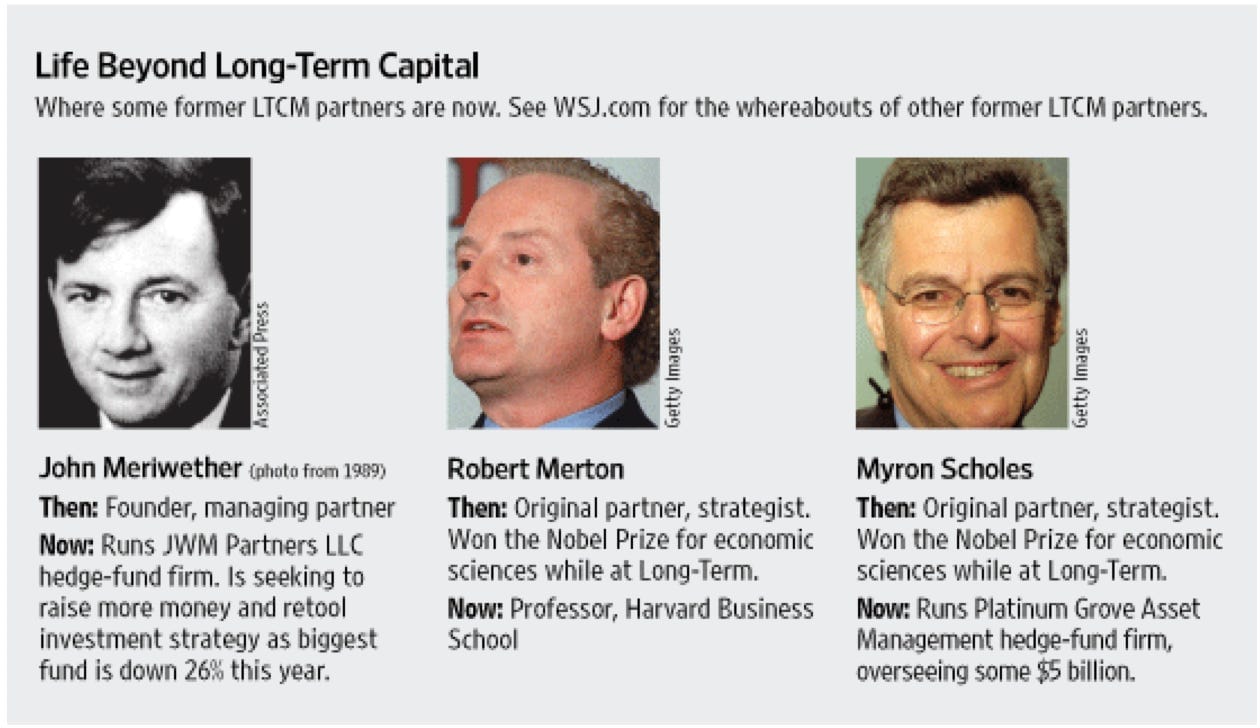

The truth is, we’ve seen this before. Back in the late 1990s, a hedge fund named Long-Term Capital Management (LTCM) was considered untouchable. It was led by some of the smartest people in finance — Nobel Prize winners, mathematicians, and top traders from Wall Street’s elite firms.

Source:Wall Street Journal

These were not gamblers. They built models, ran simulations, and believed in the math. Their trades weren’t wild speculations; they were “guaranteed” arbitrage opportunities where tiny price differences between assets could be exploited for profit. The returns were small, but steady — and with enough leverage, those small returns turned into massive gains.

So they borrowed. A lot.

One of their biggest positions was a bet that European interest rates (sounds familiar?) would converge once the euro launched. On paper, it was flawless logic. The euro would unify Europe’s monetary system, meaning rates across Italy, Spain, and Germany should eventually align. LTCM went all in, convinced it was free money. But then, in 1998, the Russian ruble collapsed. Their counterparties (Russian banks) defaulted, liquidity evaporated, and margin calls started rolling in.

To raise cash, LTCM had to unwind its European trades. But everyone else was already in the same trade. Solomon Brothers, other big banks, all had similar positions. And when everyone tried to sell at once, there were no buyers left. The market froze, spreads blew out, and in a matter of days, LTCM was finished. Even Salomon Brothers, one of Wall Street’s strongest firms, went down with them.

Only if they were true to their name: “Long Term and Capital Management”

Here’s the twist: LTCM was right. The euro did come into existence, and the interest rates did converge. But they didn’t live long enough to see it happen. They were wiped out not because they were wrong, but because they were overleveraged and overconfident.

Source: Coindesk

Fast forward to today, and the crypto market has just played out the same script. Traders were convinced that crypto could only go higher. Leverage piled up as investors borrowed against positions, confident that Bitcoin and Ethereum would keep climbing. Meme coins with no real value were treated like guaranteed winners. Then came the shock — a Trump tweet, a liquidity crunch, and the chain reaction began. Billions in leveraged long positions were liquidated almost instantly. Prices tumbled, liquidity vanished, and the same “can’t lose” optimism turned into panic selling.

Source: X.com

It’s a painful reminder that markets don’t punish intelligence, they punish arrogance. Being right about the future means nothing if you can’t survive the present. The biggest lesson from LTCM, and from this crypto crash, is that leverage kills, especially when everyone believes they’re too smart to fail.

“My partner Charlie says there [are] only three ways a smart person can go broke: liquor, ladies and leverage.”

Munger who partnered with Warren Buffett at Berkshire Hathaway often emphasized the importance of discipline in both personal and financial life. He believed most financial ruin stems from emotional decisions not bad math.

The quote continues to resonate with investors as a cautionary reminder to stay grounded and avoid overindulgence or risky borrowing.

The investors who last decades in this business aren’t the ones chasing 200% returns; they’re the ones compounding quietly at 15–20% and never blowing up. It’s not about how much you make, it’s about how much you keep. Because when you’re forced out of the game, recovery is no longer an option.

As we move forward from this week’s chaos, the smartest move isn’t to chase the next rebound. It’s to reset, de-lever, and focus on survival. Hold more cash, manage exposure, and wait for opportunity to come to you. The market always gives second chances but only to those who are still standing.

However, given the greed of human nature, I am certain that this will not be the last time we see such flash crash. LTCM-type of behaviour will always be with us. Your job as an investor is to survive the event, and capitalise on it.

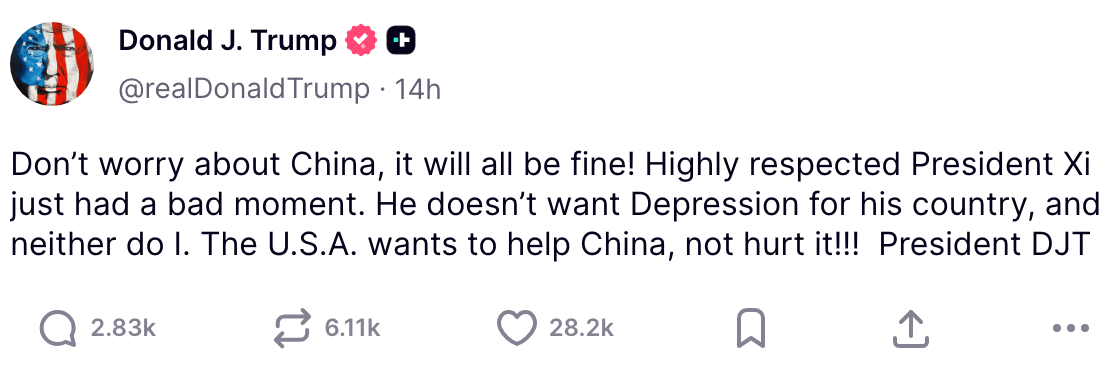

In fact, Trump has since reversed his statement and send out the following tweet.

With much of the leverage flushed out of the system, I am getting interested in buy more crypto now and if you want to learn more about crypto, there is a free event coming up:

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Happy Hunting!

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.