- Invest With Pete

- Posts

- what happened?

what happened?

Hi everyone,

PayPal was once the undisputed king of online payments. It was the best system back in the days, but today it is a shadow of its former self. Even David Marcus, a former employee and leader at the company, has recently come out to voice concerns about its current state.

This is a classic example of a value trap. While it once held a monopoly, it fell victim to a slow reaction to change and the rise of agile competitors.

A Shift in the Digital Landscape

During a recent livestream, a viewer asked for my views on PayPal. It made me realize that I cannot remember the last time I actually used it. I used PayPal to start my business years ago, but now almost everything runs through Stripe.

If you want to understand how a giant fails and recently tanked 20% overnight, the warning signs were there. To put it simply:

💵 The stock looked cheap based on previous earnings.

🔽 The actual earnings kept deteriorating.

🔪 The "cheap" price was actually a falling knife.

I vividly remember a fellow investor taunting this as a "value play" that everyone else was missing. I am not sure how that turned out, but I truly hope the followers did not act blindly on those words.

Why Quality Research Takes Time

This is exactly why my analysts and I conduct at least 100 hrs of research before we even consider an investment. Even if we feel very confident midway through the process, I always push for an additional 50 hrs. We do this because we might find "dirt" 😅 or hidden risks that others have overlooked.

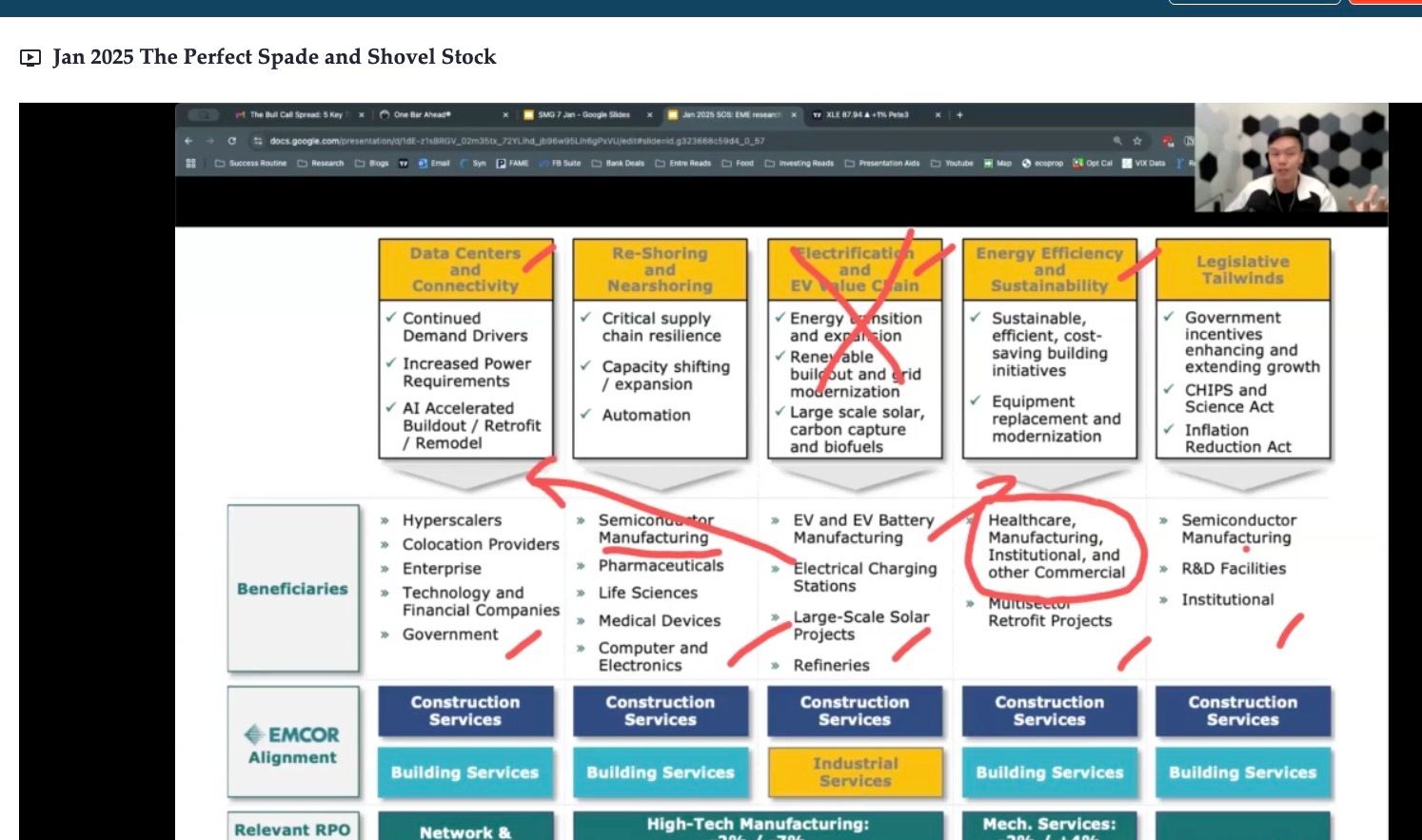

This rigorous standard is why I told my SMG members that I can only generate one good idea per month 🙏. That is how long the process takes. It can sometimes take longer, but it will never be shorter. We must never compromise our quality or jump on an opportunity too quickly. One example is EME, which I shared almost one year ago and now it is up 58%.

Protecting Your Capital

We applied this same caution to Silver. I was very hesitant to invest given the surrounding hype, so I chose to sell PUT options with a huge buffer instead. We may not have earned a massive premium because the trade was so safe, but we did not lose our capital. In this game, that is what matters most.

The SMG Promise: Your money is just as precious as mine. I promise to keep putting in at least 100 hrs of research behind every stock idea we share.

Keep chasing profits, but make sure you are investing in high quality research before you take action.

A Note on Fairness

A few people have reached out over the last few days asking if I could extend our current promo. With the sudden market madness making everyone a bit nervous, I understand wanting a bit more time to make a decision.

I want to be fair to everyone, so I have decided to keep the doors open a little longer.

I am extending the USD150 OFF promo until this Sunday, Feb 8. If you have been on the fence, this is the perfect time to join the community and get our real time trade ideas as we navigate this volatility together.

Promo Code: “2026”

Final Price: USD609 (Yearly)

Deadline: This Sunday, Feb 8.

Let’s stay rational while the rest of the market panics. 🥂

Happy Hunting!

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.