- Invest With Pete

- Posts

- when is this ending?

when is this ending?

Why is the market crashing AGAIN?

Number 1 reason: because I missed my regular Thursday night livestream! 😂

But seriously, here are the real reasons in my opinion.

1. Indiscriminate Selling & The Margin Call Trap

What we are seeing right now is indiscriminate selling stemming from margin calls and heavy leverage in the system. It goes something like this: many hedge funds and institutions are running at almost 100% invested. When they lose money in one area, they are forced to sell something else to cover the gap. This is further worsened by exchanges increasing their margin requirements during such a high VIX environment.

Therefore, all sectors are falling. No one is spared when the machines start selling to find liquidity.

2. The Big Boys are Buying the Dip

However, while the headlines look scary, the "Big Boys" are adding back fast. Recent filings show that Vanguard and BlackRock are actually adding to the Magnificent Seven.

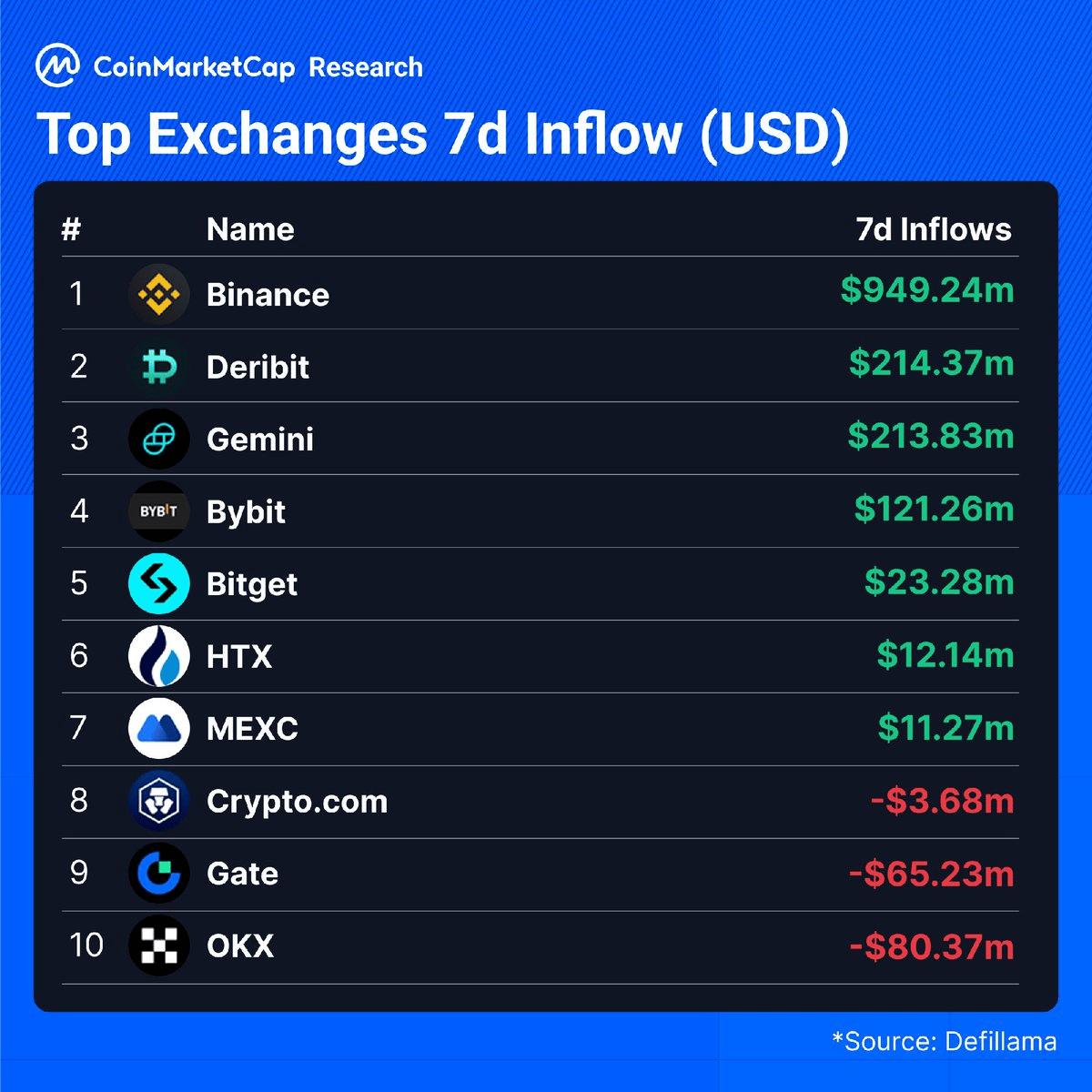

Bill Ackman, Citadel, Millennium, and Point 72 remain heavily positioned in tech, particularly AI infrastructure and specific cyclicals. We are seeing this clearly in the crypto market too.

It is the same script every time: the smart money buys while the crowd panics. Individual investors are panicking, but the world’s most successful investors are going shopping. That inevitably shows up in the SEC filings after each big dip.

3. The Crypto Flush

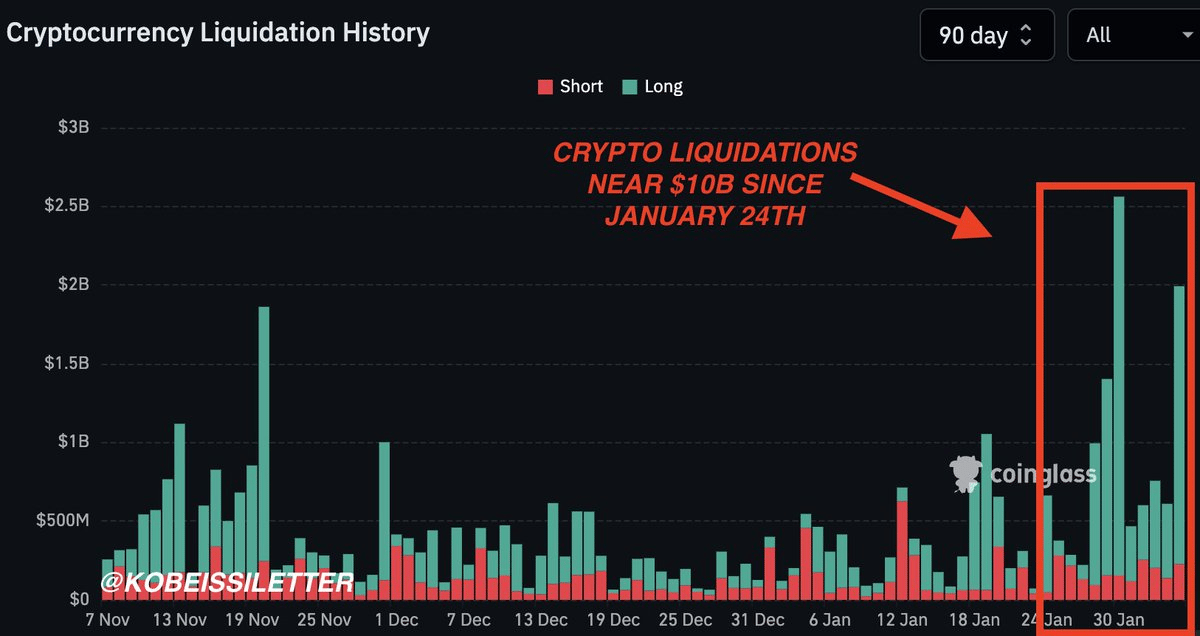

When will the selling stop? It stops when the liquidations of leveraged positions are complete. We have seen massive liquidation levels in crypto over the last month. In my last SMG members LIVE, I shared that Bitcoin was likely to fall further, and I am counting on it. Be patient, SMG members!

While this data is not as transparent for the equity market, we can watch for when market liquidity starts to resume.

The Bottom Line

Ultimately, if you zoom out far enough, every bear market and crash becomes a rounding error.

I am seeing loads of people make decisions right now that they will almost certainly regret. I do not want you to be one of them. It is important to remember that wealth is not built overnight, but one step at a time, over time.

This is not our first rodeo. If you are not investing when the stocks are down, you do not deserve the profits when they are up.

A lot of people do not understand this, but you need extreme levels of fear and irrationality at the bottom to get exceptional future performance. It is just the way it works.

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.