- Invest With Pete

- Posts

- Why Broadcom Jump 24% in a Day?

Why Broadcom Jump 24% in a Day?

and is it too late to invest?

Good Morning.

The biggest news last week was Broadcom! It jumped 24% since their latest earnings release. Lets dive into the “Why” and “What should investors be looking out for”! Also you will find the next “Invest with Pete” livestream registration link at the end of email.

Broadcom: Riding the AI Wave—Opportunities and Challenges

Broadcom Inc. (AVGO) has been making waves with its impressive growth, particularly in AI-related revenues, and remains a key player in the tech sector. However, with lofty valuations and sector dependencies, investors must tread carefully. Here’s a comprehensive look at the pros, cons, and actionable advice for investors—whether you’re a current shareholder or considering an entry.

📈 The Pros: Why Broadcom Shines

AI Revenue Explosion

Broadcom’s AI-related revenue soared by 220% YoY, hitting $12.2 billion in Q4. This growth is driven by surging demand for AI chips and infrastructure solutions, positioning Broadcom as a major beneficiary of the ongoing AI boom.Diversified Revenue Streams

Broadcom doesn’t just rely on AI:Semiconductor Solutions contributed $8.2 billion, and

Infrastructure Software generated $5.8 billion.

This diversification offers resilience and multiple avenues for growth.

Strategic Partnerships

Partnerships with industry giants like Apple, including work on in-house AI server chips, strengthen Broadcom’s competitive edge and reinforce its relevance in key markets.Strong Financial Performance

Revenue surged 51% YoY in Q4 FY2024 to $14.05 billion, outpacing expectations.

Broadcom increased its quarterly dividend by 11%, marking 14 years of consecutive hikes—a reflection of its growing cash flow and shareholder commitment.

Optimistic Market Outlook

The company expects AI revenue to grow another 65% next quarter and projects Q1 FY2025 total revenue of $14.6 billion, surpassing analyst forecasts.Market Recognition

Broadcom recently hit the $1 trillion market cap milestone, underscoring its dominance in the tech space and its increasing appeal to institutional investors.

📉 The Cons: Challenges to Watch

Valuation Concerns

Broadcom’s stock has been riding high, but some analysts warn that AI enthusiasm may be overblown, leaving the stock vulnerable if the company doesn’t deliver on growth expectations.Overdependence on AI

While AI is a growth driver, it now makes up a significant portion of Broadcom’s revenues. A slowdown in AI adoption could disproportionately impact the company’s future performance.Competition in AI Chips

Competitors like Nvidia and AMD are aggressively expanding their presence, which could erode Broadcom’s market share over time.Broader Economic Risks

Supply Chain Concerns: Geopolitical tensions could disrupt semiconductor production.

Market Saturation: The tech sector’s growth may slow as markets mature.

Limited Non-AI Innovation

Critics point out that Broadcom’s growth outside AI has been relatively flat. Without significant breakthroughs in other areas, Broadcom could face challenges sustaining its overall momentum.

💡 What Should Investors Do?

Whether you’re a current shareholder or considering Broadcom, here’s some possible options (of course these are not investment advice, please do your own due diligence)

If You’re Already a Shareholder:

Stay Cautious But Hold: Analysts suggest holding onto shares but keeping an eye on valuation levels. Broadcom’s growth potential, especially in AI, remains strong, but the current lofty valuations require a watchful approach.

Monitor Key Metrics: Focus on Broadcom’s AI revenue growth and any developments in its diversified segments, such as infrastructure software.

If You’re Considering Buying:

Wait for a Pullback: Given the stock’s high valuation, many experts recommend waiting for a dip before entering. A pullback could provide a more attractive risk-reward balance.

Look for Confirmation of Growth: Watch upcoming earnings reports and market performance for confirmation that AI-related revenues are sustainable and that other segments are showing strength.

📊 Final Thoughts

Broadcom’s story is one of incredible growth and strategic positioning, particularly in the AI revolution. While it’s a compelling investment for long-term growth, high valuations and overreliance on AI revenues mean that caution is warranted. Whether holding or considering a buy, focus on the company’s ability to maintain momentum across its segments and its capacity to innovate beyond AI.

Invest with Pete Livestream!

This week we have the most highly anticipated FOMC! It is the last of 2024 and many things are riding on Fed’s final decision before 2025.

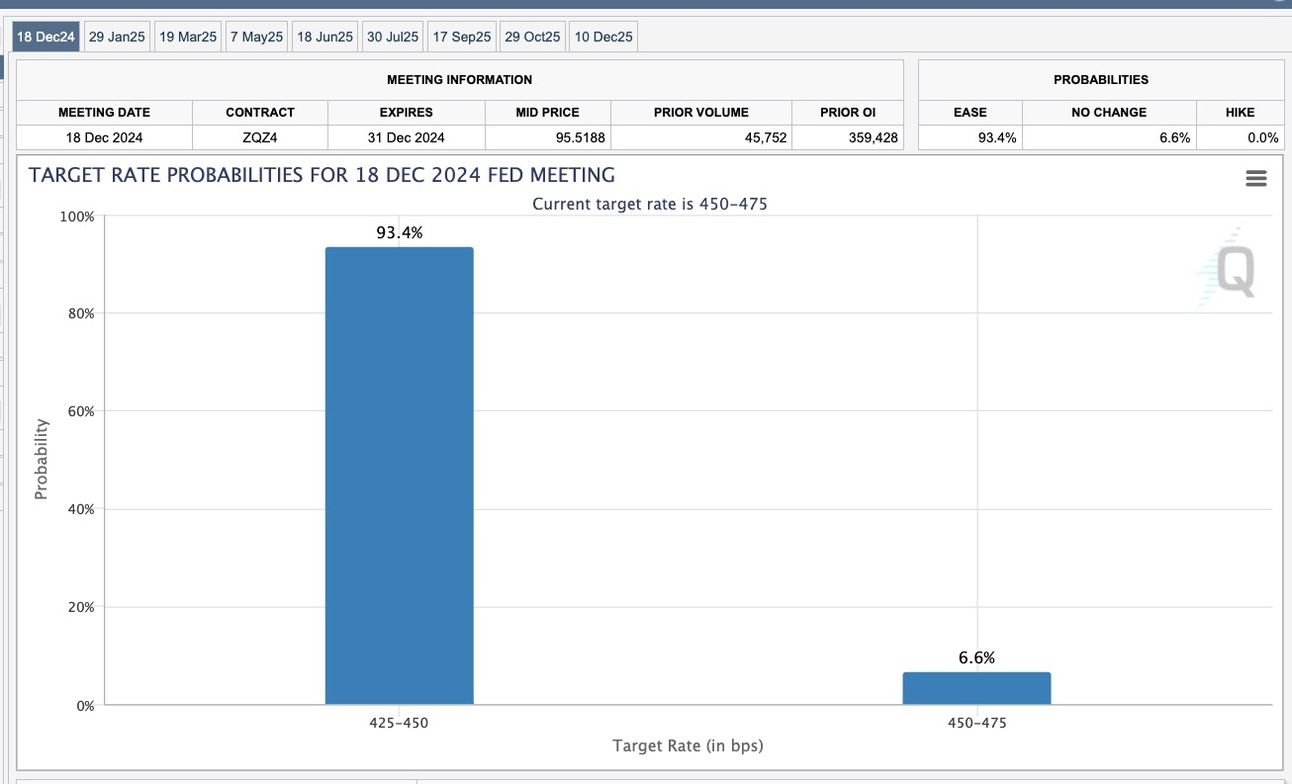

While nothing is certain in the investing world, CME Fedwatch gives a 93.4% chance of a 25bps cut 😃 This should bring smiles to everyone’s face.

So we will be having our Invest with Pete (IWP) Livestream this Thurs 9pm SGT! We are gonna talk about:

Interest rate moves and its impact

How is the market going into 2025?

What is Pete doing as an investor?

Alright! This should get you ready for the markets this week!

May Your Profits Grow!

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.