- Invest With Pete

- Posts

- Why he thinks market will drop soon?

Why he thinks market will drop soon?

1. Gaza Peace Plan

Markets are jittery as global headlines collide, from central bank signals to shifting investor sentiment. But one story is taking center stage: the emerging Gaza peace plan.

Source: BBC

If negotiations gain traction and a lasting truce holds, it could shift the global risk mood dramatically. Peace in the region would ease geopolitical risk premiums, stabilize energy markets, and boost investor confidence, especially in European and Middle Eastern equities. Oil prices, which have been swinging on every headline, could steady or even edge higher if reconstruction efforts spark demand across energy and materials.

In short, a breakthrough in Gaza could become a short-term tailwind for risk assets, adding fuel to markets already pricing in a soft-landing narrative. But investors should stay nimble, as optimism can turn quickly if talks stall or politics complicate progress.

2. Jamie Dimon Sounds the Alarm

JPMorgan CEO Jamie Dimon made waves this week with a blunt warning that the U.S. stock market may be overheating, and a correction could arrive within the next six to twenty-four months. He said he is “far more worried than others,” pointing to inflated valuations and complacent risk-taking.

Source: Reuters

Dimon’s concern centers on the AI-fueled rally, where optimism about productivity gains has lifted market multiples to dizzying heights. He cautions that uncertainty is being underestimated and that investors should prepare for more turbulence than markets currently imply.

That said, it is worth remembering that Dimon’s track record on market timing is not spotless. Over the years, he has issued several cautious outlooks that never materialized into major corrections. While his perspective carries weight given JPMorgan’s size and access to market data, investors should not treat his warnings as gospel.

The takeaway: respect the warning, but do your own due diligence. Dimon’s message is a reminder to check your exposure, not an order to sell everything.

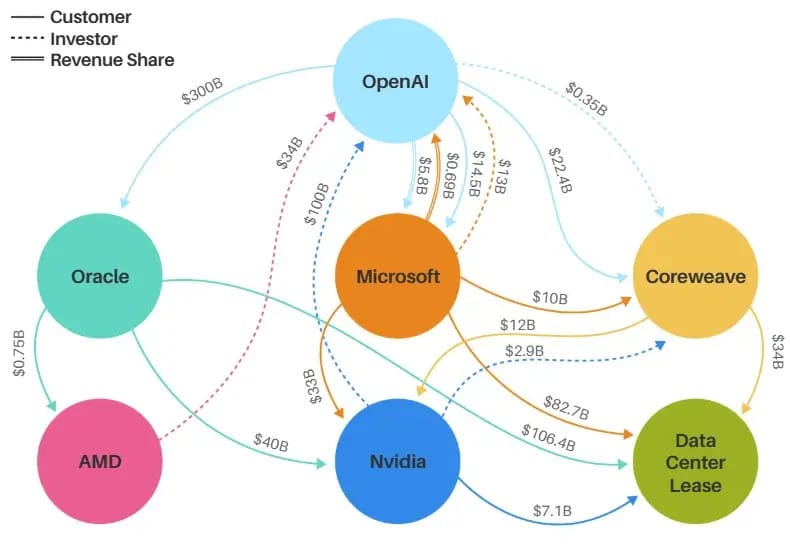

3. The AI–Tech Conundrum: Money Going in Circles

Here is where things get interesting, and a little dizzying.

Source: Morgan Stanley

Take a look at today’s AI money loop (see chart above). Microsoft invests billions into OpenAI. OpenAI spends on Nvidia GPUs. Nvidia partners with CoreWeave to lease massive data centers. CoreWeave, in turn, supplies compute back to Microsoft and OpenAI. Add Oracle and AMD into the mix, and the same capital keeps flowing between the same few players.

It is an impressive ecosystem, but also a closed one. Money is not necessarily spreading across the broader economy. It is recycling within the AI elite. That concentration means a shock to one player, such as a slowdown in AI demand or a bottleneck in GPU supply, could ripple quickly through all of them.

So while AI remains the market’s favourite story, the structure looks eerily like a feedback loop: massive capital expenditures justified by the same circle of demand.

For investors, that is a flashing yellow light.

Be impressed, but be cautious.

Diversify beyond the “AI Big Five.”

Watch for signs of saturation in data center buildouts or model demand.

Momentum trades often look unstoppable until the money stops circulating.

4. What This Means for Investors

When a seasoned voice like Dimon raises red flags, it is worth listening, but with perspective. His message is less about calling the top and more about managing risk before the crowd reacts.

Here is how I am thinking about portfolio positioning:

Strategy | Rationale |

|---|---|

Trim exposure in high-flying AI and tech names | Valuations leave little margin for error. |

Add stability via defensive or value sectors | Diversify away from concentrated momentum trades. |

Keep some dry powder | Flexibility is an underrated advantage in choppy markets. |

Monitor credit spreads and bond yields | Early warning signals often show up there first. |

Stress-test “what if” scenarios | Know your downside before it finds you. |

It is not about timing the top; it is about being ready for whichever direction markets take next.

5. 📌 Bottom Line

We are entering a more fragile market phase where narratives can shift fast and liquidity can disappear faster. Dimon’s warning adds to the sense that valuations, particularly in AI-driven sectors, may be stretched, but it is not a call to panic.

At the same time, a credible Gaza peace plan could inject a fresh dose of optimism, reminding investors that geopolitical relief can be as powerful as economic data in shaping market tone.

And when it comes to AI, remember: innovation is real, but so are bubbles. If the same dollars keep spinning between the same players, eventually someone ends up holding the bill.

💡 Want to Go Deeper?

If you enjoy these breakdowns and want to level up your investing mindset, check out Stock Market Genius — a practical guide to spotting opportunities before the crowd does. It’s packed with insights on how to think like a long-term investor in a short-term world.

👉 Join the Stock Market Genius community today and start turning insight into intelligent action.

Until next time, stay sharp.

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.

And if you want to read more about AI, check this out 👇️

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.