- Invest With Pete

- Posts

- will rate cut happen?

will rate cut happen?

A December Fed Rate Cut Is Suddenly Back on the Table And Now Even the Hawks Are Shifting

Hey everyone,

The macro landscape just shifted again.

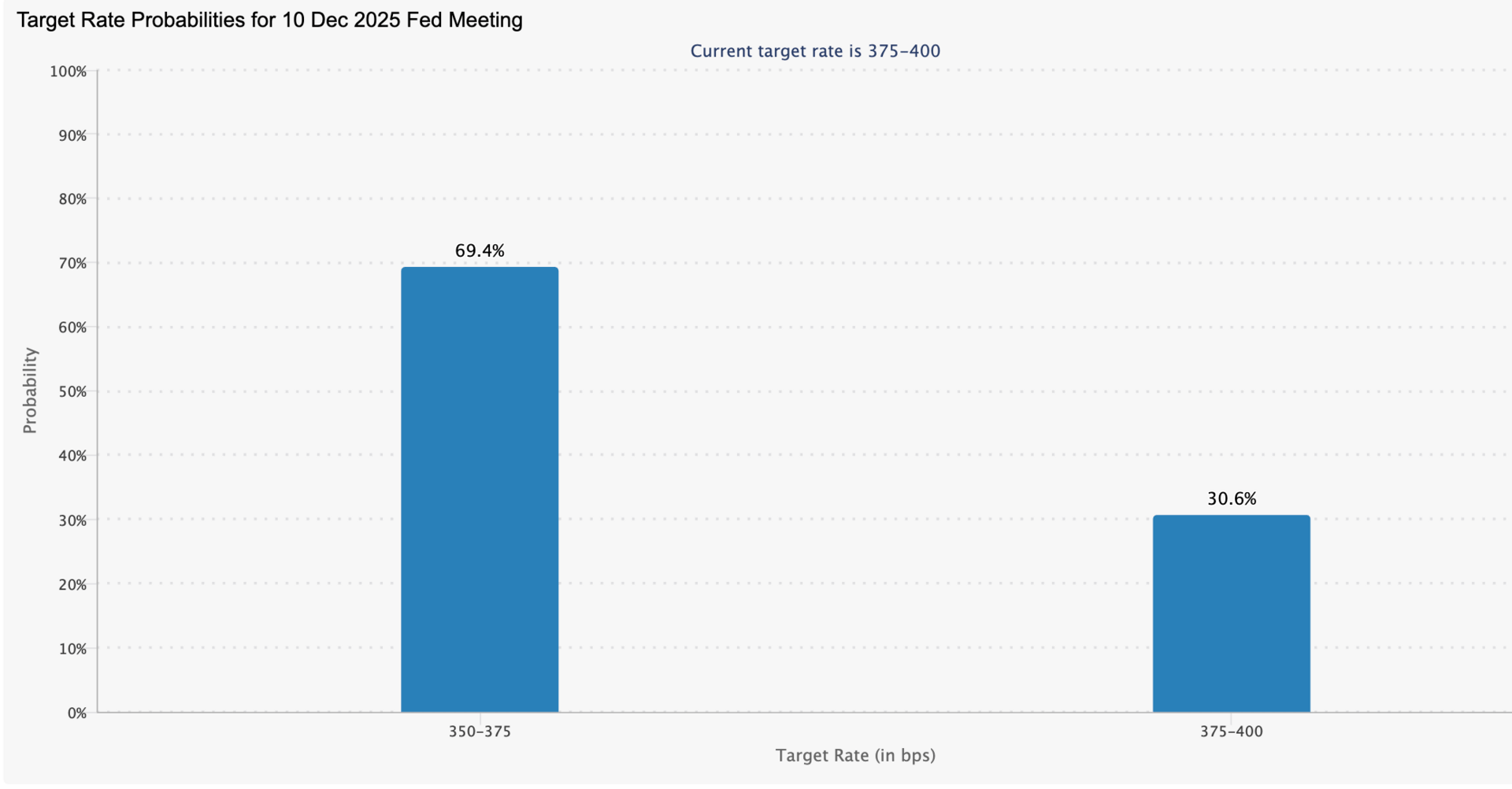

What looked like a doubtful rate cut for December is now looking very likely with markets jumping from forty percent odds to 70% within a day.

Source: CME Fed Watch

And now, a new twist:

Fed Governor Stephen Miran is openly pushing for even bigger cuts — up to 50 bps.

Let’s unpack everything.

1. The Job Market Is Weakening Faster Than Expected

The first wave of official data post shutdown paints a worrying picture:

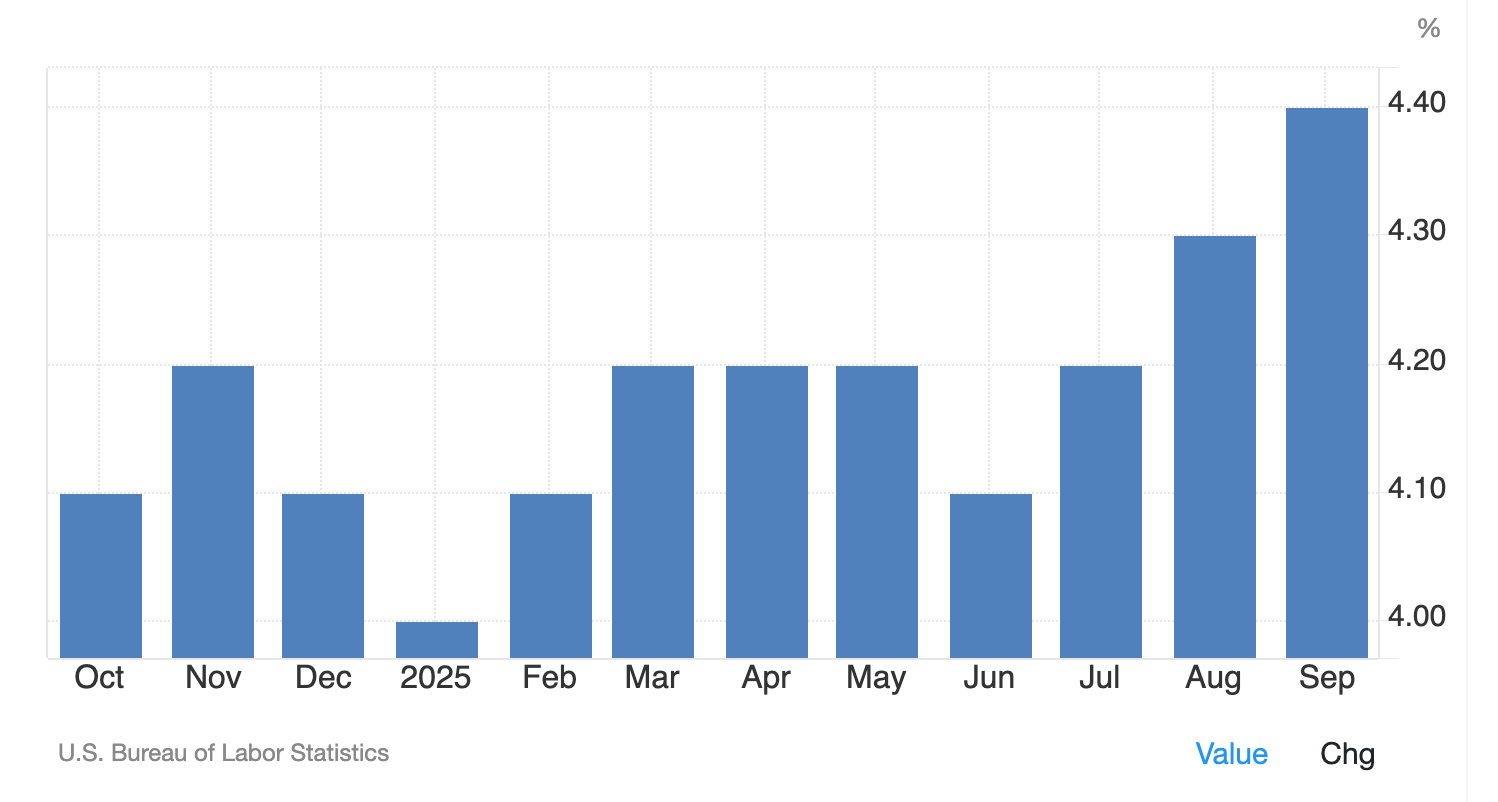

• Unemployment rose to 4.4 percent, a four year high

• Hiring momentum is fading

• Economists describe the labour market as precarious

This deterioration is now the core justification for another rate cut.

Wells Fargo and Deutsche Bank both say the data alone is enough for the Fed to act.

2. Powell’s Inner Circle Is Quietly Aligning Behind a Cut

Three of the most influential voices are now leaning in the same direction:

• Jerome Powell

• John Williams

• Christopher Waller

Williams’s recent comments, saying he still sees room for “further adjustment”, were strong enough to move markets by themselves.

This is why cut expectations spiked sharply.

3. Trump’s Appointed Fed Governor Stephen Miran Wants to Go Even Faster

Fed Governor Stephen Miran, appointed in September, is arguing for a more aggressive easing path:

• Says the Fed doesn’t need to move faster than 50 bps

• But is fully open to another 50 bps cut

• Dissented in the last meeting, pushing for a bigger cut than the 25 bps the Fed delivered

• Believes current policy is “overly restrictive” and risks choking economic growth

• Thinks additional cuts are essential to avoid an unnecessary output gap

Miran represents the more vocal, pro easing wing inside the Fed.

His comments give rare insight into the internal pressure building.

Even more interesting:

Treasury yields barely moved, meaning markets already anticipated Miran’s stance.

But if labour market weakness continues, his push for steeper cuts could influence the December meetings.

4. The Economy Is Softening and the Fed Is Divided

Economic data is showing clearer signs of weakening, but the Fed is not united:

• Some want to pause

• Others see stagflation style risks: higher unemployment, sticky inflation, strong spending

• Shutdown delays mean no fresh CPI or jobs data at the December meeting

Powell may ultimately deliver an “insurance cut and pause” to avoid triggering inflation fears

What This Means for Markets

If the Fed cuts:

• Momentum assets could get a short term pop

• Bonds may stabilise as “insurance cut” messaging anchors expectations

• Liquidity should improve

• But underlying economic weakness is real

If Miran’s push for bigger cuts gains traction later:

• Housing, cyclicals and rate sensitives could see a strong rebound

• Longer duration assets may rally

• But it may also confirm deeper economic cracks

We’re in a macro environment where liquidity is the dominant driver, not earnings.

📈 Pete’s Trade Ideas: How I’m Positioning for a Fed Cut & Weakening Economy

Here’s how I’m viewing opportunities right now based on the macro backdrop.

1. High Quality, Cash Flow Heavy Tech

A rate cut environment generally supports:

• Mega cap tech

• Strong balance sheets

• Companies with high free cash flow and pricing power

I’m watching:

• NVDA

• MSFT

• GOOGL

• AMZN

These companies benefit from lower discount rates and should get tailwinds if liquidity improves.

Strategy: Short term spreads or long term options for exposure without over committing capital.

2. BTC and Gold as Conviction Hedges

A slowing economy + rate cuts + disinflation narrative = tailwinds for hard assets.

BTC

Still my high conviction long term asset. Pullbacks are opportunities.

Gold

We already saw gold break higher recently as liquidity fears spiked.

This is a macro hedge and rate cuts help.

Strategy:

• For BTC: BTFD with strict sizing

• For gold: Synthetic long or debit call spreads on GLD

Happy Hunting!

Pete

Invest with Pete

🚨‼️ By the way, I’ll never PM anyone on telegram or any other social media platforms. If you receive any “Pete” messaging you, these are scammers impersonating me. Pls beware!

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that while Pete is a portfolio manager, the opinions expressed in this newsletter are his own and do not represent the views of any organization. Always perform your own research and due diligence before investing.